Content

Many if not most people opt for online payday loans because of emergencies, and by virtue of the financial urgency, they typically need a company that processes their loans fast. To ensure you access legitimate payday lenders from the word go, we curated this list of the best payday loans that showed the ability to provide you with fast reliable loans on reasonable terms. Instead, the lender will normally ask you for permission to electronically take money from your bank, credit union, or prepaid card account.

- An unusual question from PersonalLoans.com is what each applicant plans to use the money for.

- The platform has a robust and wide range of products to help you access affordable finance for various needs and purposes.

- Loan approval and actual loan terms depend on your ability to meet our credit standards .

- The platform which is best for good customer service strives to provide borrowers and mobile users with convenient lending and quick loan services.

- Also, the lender will provide you with the terms and conditions that you must read carefully and make sure there are no scams or any type of hidden fees.

- Compared to other online lending marketplaces, PersonalLoans’ loan terms are standard.

Check Into Cash is a licensed payday lender that offers a variety of loans both in-store and online. After you have picked a loan offer provided by one of MoneyMutuals lenders, you’ll be directed to their website to complete the application and get the money within 24 hours. The amount you can borrow and the APR you are offered will depend on several factors, including your income, credit history, state of residence, and the lender you connect with. This is why I’m writing this post to talk about the ten best payday loans I would recommend. In these situations, many of us turn to payday loans for help. The best payday loan providers have a strong reputation and all the necessary paperwork to back their marketplace.

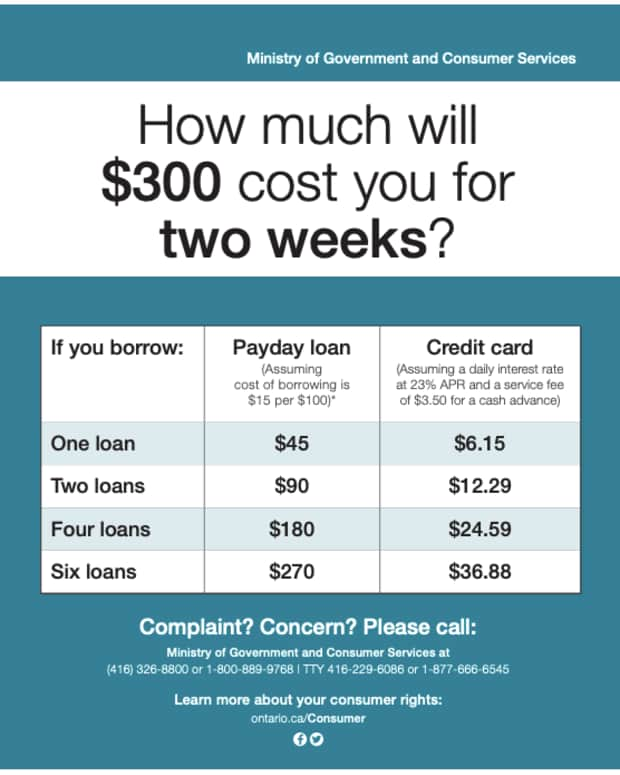

$300 Installment Loan

When it comes time to repay, your lender will deduct the principal amount and any fees you owe from your bank account — or cash the check you left. Make sure you have enough money in your bank account on your due date. Otherwise, you could face steep nonsufficient funds fees and overdraft fees from your bank. Overdrafting your account can be the closest alternative to taking out a payday loan — it’s fast, you don’t need good credit and you can get the money instantly. Another way lenders increase the amount you pay on installment loans is by adding origination or acquisition fees. This fee is usually a flat dollar amount added at the beginning of the loan.

#2 Bad Credit Loans: Top Rated Payday No Credit Check Loans For Bad Credit

Users who have a Dave expense account have their website access to larger loan amounts than those who don’t. The app also has a “Side Hustle” feature that helps users find side jobs to earn more money. Because they are secured using your home as collateral, home equity loans and HELOCs usually have better interest terms than unsecured options such as personal loans or credit cards. True American Loans is a bad credit loan lender offering their services primarily for True Americans.

This is because in most situations, failure to repay an online loan or any loan for that matter does not constitute a criminal offence since it is strictly a civil issue. Civil debts are those incurred via personal loans, wages, mortgages, or credit cards; thus, nonpayment of a loan does not result in imprisonment. You can get a quick loan on the Renmoney app in just a few steps. Renmoney quick online loans are for employed or self-employed people as well as business owners.

Often, loan funds are directly sent into your checking account within 24 hours, or in 48 if you’re asked for additional information. After carefully reading through the fine print, pick a lender that gives bearable terms to avoid any trouble when it’s time to repay. The interest rates on the service are between 235% to 1304% APR, but 247DollarLoan doesn’t get into the specifics of what its lenders charge in rates. And yes, they judge your eligibility for a short-term loan by the information you give and not your credit history, which is good news if your credit record isn’t the best. Putting through an application takes as little as five minutes, and you’re also sure to get a loan response in real-time in a matter of minutes too.

You may be eligible for an unsecured personal loan even if you have fair or bad credit. But you may want to shop around to make sure the interest rate and monthly payment is affordable for your budget. If you want to borrow money, there are a number of different loans to consider.

Best For Comparing Multiple Offers

They also check through third-party lending networks for suitable matches. In addition, they are transparent to borrowers about how they operate. When you default on your repayment, the platform does not get involved. Please do review the requirements and eligibility criteria when you apply. The amount you can borrow is a percentage based on your home’s equity — usually up to 85%. Your home equity is the difference between what you owe on your mortgage and your home’s current market value.