One other way of going a loan on the less than perfect credit is placing your property upwards as the collateral. For many who own a house, you can purchase a loan against they by the placing it upwards since the safeguards toward financing. House collateral finance are going to be availed no matter what your credit score. People with less than perfect credit who have security inside their households normally rapidly score that loan. Also, such fund were reduced-desire money once the household functions once the cover into the loan. Yet not, you need to be conscious that if you can’t pay off the mortgage, your house will be confiscated, and reduce your property.

Borrowing from the bank of Best friends and Family unit members

Borrowing from the bank money from friends ‘s the last resource; it doesn’t cover any records, and you’ll actually get it with no notice. However, you ought to imagine numerous activities in advance of asking people friend for a loan because it you’ll damage their matchmaking for people who fail to spend right back this new lent count.

Poor credit financing and also the repayable count may vary based several points. Your credit score, extent your use, plus paying capabilities is also subscribe to the speed you score with a less than perfect credit mortgage.

If you have a good credit score and then make a reputable sum of money, you might borrow significantly more, whereas when you yourself have a poor credit score and do not build sufficient currency, you may not manage to obtain much.

While applying for a bad credit financing, you need to think several activities, as well as skipped fee costs, very early payment fees, or any other costs.

The fresh borrowable count varies from bank so you can lender. Particular poor credit lenders allow it to be individuals to use between $500 to $5000, while anybody else you’ll allow representative acquire as much as $fifty,100, subject to different facets.

Selection to Bad credit Financing

There are choice to a less than perfect credit mortgage. Before you apply to possess a less than perfect credit mortgage, you will want to envision several activities and determine exactly what fits their condition. Listed below are a knowledgeable choice in order to bad credit loan providers:

Payday loans Apps

Cash advance Apps eg Chime, Dave, and you can Earnin are perfect options if you would like a cash advance on your own salary. Although there try a borrowing limit throughout these apps, they give you higher possibilities in order to less than perfect credit fund as they are finest if you need small quantities of cash for emergencies.

Unsecured loans

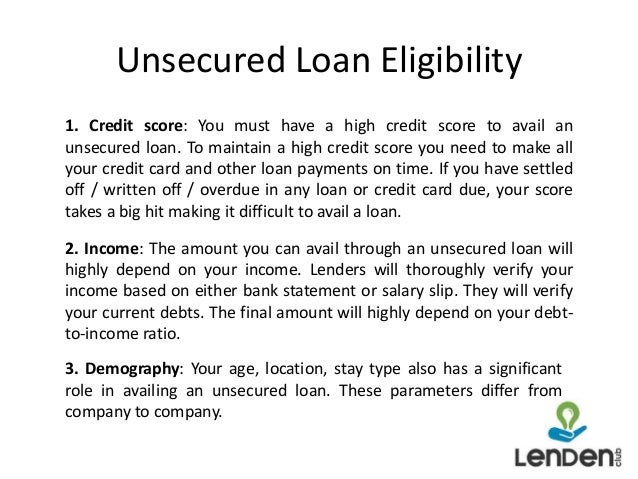

Signature loans are also suitable selection to help you bad credit fund just like the he’s all the way down APRs. People with poor credit results can always obtain of banking institutions and you can credit unions dependent on the issues.

Quick Money Loans

Numerous finance companies offer brief-dollar loans, being an excellent option for crisis costs. More resources for quick-money financing, you ought to get hold of your banks.

Auto Identity Loans

Automobile term money are a choice for people who own a motor vehicle. This type of money allow you to place your vehicles up as the guarantee for a loan. Nevertheless, these types of is to just be put because a last resort as they are very high priced and require one spend the money for money back in 30 days. For those who default in your fee, your vehicle try captured from the financing entity.

Peer-to-Peer Credit

Numerous on line programs assists fellow-to-peer. Some body usually render funds to anyone else getting a flat interest to locate an effective come back on their capital.

What is needed When you are Making an application for a less than perfect credit Financing?

Applying for a less than perfect credit mortgage is  relatively simple; however, you nonetheless still need to satisfy the latest qualification requirements and now have particular data able when you need to make an application for a poor credit loan. Certain lenders have other standards as opposed to others. not, most of the less than perfect credit loan providers feel the adopting the criteria:

relatively simple; however, you nonetheless still need to satisfy the latest qualification requirements and now have particular data able when you need to make an application for a poor credit loan. Certain lenders have other standards as opposed to others. not, most of the less than perfect credit loan providers feel the adopting the criteria: